catsRlife4573

07.07.2021 •

Business

Compare and evaluate Tesla financial statements based on the below points.

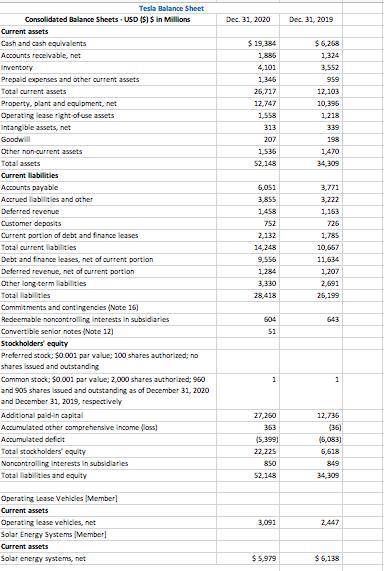

Size

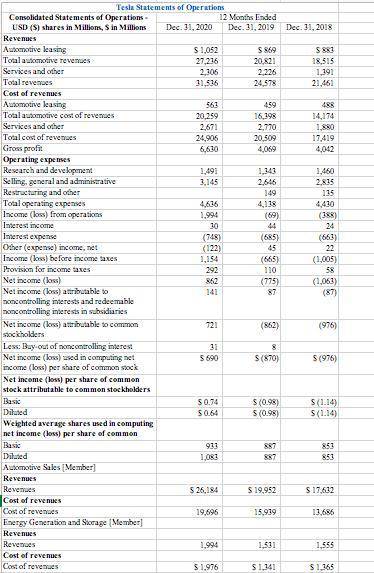

o total assets and total revenue

o market cap

Growth

o asset growth and revenue growth

o market to book ratio

o price to earnings ratio (P/E ratio)

Use following ratios or financial statemen item to compare and analyze business performance.

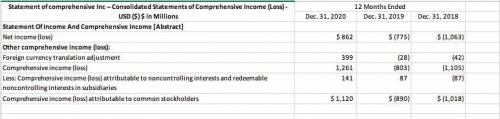

Profitability

o gross profit percentage (LO 5.6)

o return on assets (LO 1.6)

o return on common stockholders’ equity, earnings per share, and the price/earnings ratio (LO 13.7)

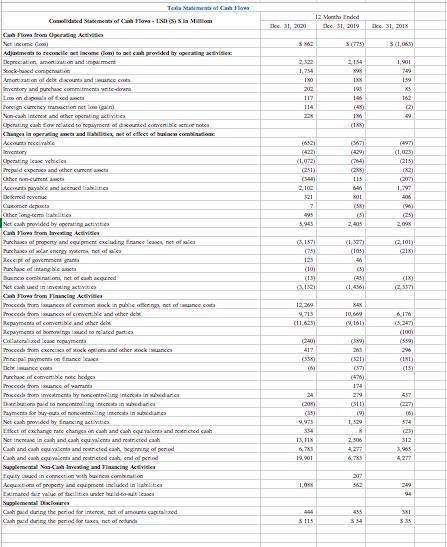

Solvency

o debt ratio (LO 2.5)

o debt to equity (12.6)

o free cash flows

Liquidity

o current ratio (LO 4.6)

o acid-test ratio (LO 8.5)

Operating Efficiency

o inventory turnover, days’ sales in inventory (LO 6.6)

o accounts receivable turnover ratio, and days’ sales in receivables (LO 8.5)

o asset turnover ratio (LO 9.6)

Solved

Show answers

More tips

- F Family and Home What is Most Important in Men s Lives?...

- H Health and Medicine Why Wearing a Back Brace Can Be Beneficial During Back Strain?...

- S Sport When and Where Will the 2014 World Cup be Held?...

- C Computers and Internet How to Choose a Monitor?...

- H Horoscopes, Magic, Divination Where Did Tarot Cards Come From?...

- S Style and Beauty How to Make Your Lips Fuller? Ideas and Tips for Beautiful Lips...

- C Computers and Internet How to Learn to Type Fast?...

- A Art and Culture Who Said The Less We Love a Woman, the More She Likes Us ?...

Answers on questions: Business

- B Business Which of the following is NOT one of the main tasks of strategy-making in a diversified company? 1. establish investment priorities so that resources are steered into most attractive...

- B Business Fabri Corporation is considering eliminating a department that has an annual contribution margin of $29,000 and $71,000 in annual fixed costs. Of the fixed costs, $13,500 cannot...

- B Business Given the acquisition cost of product Dominoe is $18, the net realizable value for product Dominoe is $16, the normal profit for product Dominoe is $1, and the market value (replacement...

- B Business This information relates to Cheyenne Real Estate Agency. Oct. 1 Stockholders invest $31,770 in exchange for common stock of the corporation. 2 Hires an administrative assistant...

- B Business Under what doctrine discussed in this chapter might Buy-Mart be held liable for the tort committed by Watts? What is the key factor in determining whether Buy-Mart is liable under...

- B Business The decision to keep or drop products or services involves strategic consideration of all the following except: The desired inventory levels of the product. Potential impact of...

- B Business What is the four-firm concentration ratio in an industry with the following market shares? Firm A 11.2 Firm C 5.1 Firm E 3.6 Firm G 1.6 Firm B 7.7 Firm D 4.6 Firm F 2.2 Other...

- E English How can the labrynth corridors be interpreted as symbols in this passage...

- M Mathematics Asap ! extra ! give the right answer...

- C Chemistry Arrange the levels of ecological organization from smallest to largest. (ecosystem, population, community, organism)...

Ответ:

1) Enter late, leave early. You don't need to show every character entering or exiting a location

2) Remember what characters dont say

3) Use long speeches or monologues sparingly

4) Use dialect sparingly

5) Avoid redundancy

6) Stay consistent

7) Make your characters distinct

8) Read your script out loud

Explanation: