lilsmitty137ovf7yw

12.03.2021 •

Business

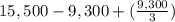

Gerald received a one-third capital and profit (loss) interest in XYZ Limited Partnership (LP). In exchange for this interest, Gerald contributed a building with an FMV of $31,000. His adjusted basis in the building was $15,500. In addition, the building was encumbered with a $9,300 nonrecourse mortgage that XYZ LP assumed at the time the property was contributed. What is Gerald's outside basis immediately after his contribution

Solved

Show answers

More tips

- C Computers and Internet Clearing Cache: How to Speed Up Your Browser...

- S Style and Beauty How are artificial nails removed?...

- S Style and Beauty Secrets of Tying a Pareo: 5 Ways...

- F Food and Cooking Everything You Need to Know About Pasta...

- C Computers and Internet How to Choose a Monitor?...

- H Horoscopes, Magic, Divination Where Did Tarot Cards Come From?...

- S Style and Beauty How to Make Your Lips Fuller? Ideas and Tips for Beautiful Lips...

- C Computers and Internet How to Learn to Type Fast?...

Answers on questions: Business

- E English Explain how and why Frederick Douglass uses objectivity in his autobiography Narrative of the Life of Frederick Douglass, an American Slave....

- C Computers and Technology Which of the following represent correct syntax to display first name from global variable user? select the one correct answer. a. {user.firstname} b. {! user.firstname}...

- B Business Jacob co. sells merchandise on credit to isaiah co. for $8,600. the invoice is dated on may 1 with terms of 1/15, net 45. what is the amount of the discount and up to what...

- S Spanish Who introduced the changes to mexican culture and diet?...

- E English Select three reasons why the cmo in the chapter example wanted to revamp the marketing plan. demand for chicken sandwiches varied widely, making it difficult to forecast...

Ответ:

The appropriate answer is "$9,300".

Explanation:

The given values are:

FMV,

= $31,000

Adjusted basis,

= $15,500

Encumbered mortgage,

= $9,300

Now,

The Gerald's outside basis will be:

=

On substituting the given values, we get

=

=

=

= ($)

($)

Ответ:

drugs, alcohol, unsafe road use

Explanation: