KaitlynLucas5132

27.09.2019 •

Mathematics

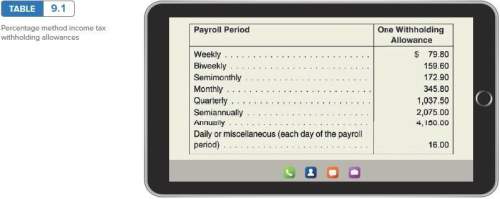

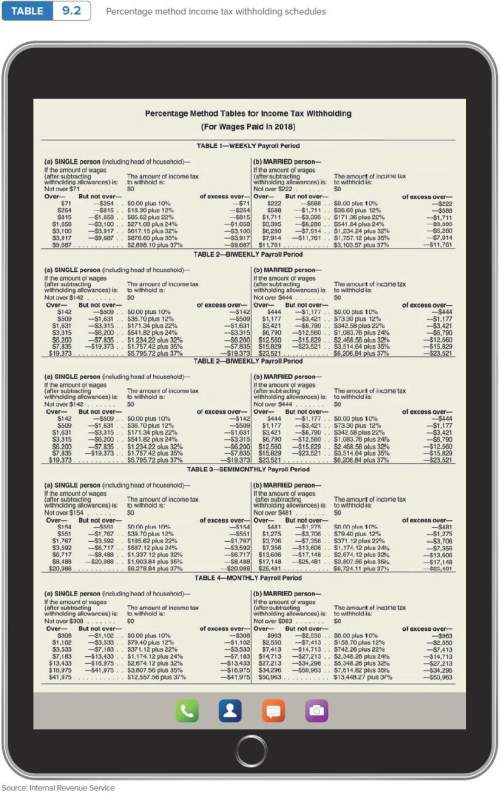

Calculate social security taxes, medicare taxes, and fit for jordon barrett. he earns a monthly salary of $13,400. he is single and claims 1 deduction. before this payroll, barrett’s cumulative earnings were $128,120. (social security maximum is 6.2% on $128,400 and medicare is 1.45%.) calculate fit by the percentage method.

Solved

Show answers

More tips

- F Family and Home What does a newborn need?...

- F Family and Home Choosing the Right Car Seat for Your Child: Tips and Recommendations...

- F Food and Cooking How to Get Reconfirmation of Registration?...

- C Computers and Internet How to Get Rid of Spam in ICQ?...

- A Art and Culture Who Said The Less We Love a Woman, the More She Likes Us ?...

- F Family and Home How to Get Rid of Your Neighbors?...

- S Society and Politics How Could Nobody Know About the Dead Mountaineers?...

- H Health and Medicine How to Cure Adenoids?...

- H Health and Medicine Why Wearing a Back Brace Can Be Beneficial During Back Strain?...

- S Sport When and Where Will the 2014 World Cup be Held?...

Answers on questions: Mathematics

- M Mathematics Mr.Jones is building a patio outside of his back door.The patio will be 8.5 ft long and 10.7 ft wide.What is the area of the patio that Mr.Jones is building?...

- M Mathematics What is with simplifying -3p + 6p...

- M Mathematics Add me on ro blox Fizzy_Lemonade2021...

- M Mathematics James is planning to spend $425 on food for his vacation this summer. This is 34% of his total vacation budget. How much is James total vacation budget?...

- M Mathematics Parth created a Box-and-Whisker Plot to show the average weight of the fish he caught over the weekend. What information from the 3rd Quartile does the graph give you? A. Three fourths...

- M Mathematics The recipe for Nestle Tollhouse Chocolate Chip Cookies calls for 22cups of chocolate chips to make 55dozen cookies. If you want to bake 99dozen cookies, how many cups of chocolate...

- M Mathematics A self-storage center has many storage rooms that are 6 feet wide, 10 feet deep, and 12 feet high. What is the volume of the room?...

- M Mathematics Select all of the true statements. Select alata 30 millimeters =3 centimeters 5 millimeters = 50 centimeters 2 meters = 200 centimeters 3300 meters = 3 centimeters 4 centimeters...

- M Mathematics Parth created a Box-and-Whisker Plot to show the average weight of the fish he caught over the weekend. What information from the 1st Quartile does the graph give you? A. Three fourths...

- M Mathematics What’s 8/1 times 7/4? can u explain how to find the answer...

Ответ: