Bigbabybrudis

12.12.2019 •

Mathematics

Tim tradesman estimates his taxable income will be $7,500. he is paid every two weeks or 26 times a year.

because tim has only one source of income, he uses the tax tables to estimate how much will be deducted form his pay for withholding.

1. finds the tax rate for his income level =%

2. enters the base amount =$

3. enters the amount of tax owed =$

4. divides by = $

Solved

Show answers

More tips

- S Society and Politics How Could Nobody Know About the Dead Mountaineers?...

- H Health and Medicine How to Cure Adenoids?...

- H Health and Medicine Why Wearing a Back Brace Can Be Beneficial During Back Strain?...

- S Sport When and Where Will the 2014 World Cup be Held?...

- C Computers and Internet How to Choose a Monitor?...

- H Horoscopes, Magic, Divination Where Did Tarot Cards Come From?...

- S Style and Beauty How to Make Your Lips Fuller? Ideas and Tips for Beautiful Lips...

- C Computers and Internet How to Learn to Type Fast?...

Answers on questions: Mathematics

- M Mathematics This is very hard teacher didn t teach us yet...

- M Mathematics Industrialization caused all of the following except which one? oa) the development of guilds o b) the building of canals and roads oc) the growth of cities o d) it completed the...

- M Mathematics What does n equal in this problem? -2(n+1)=6...

- B Biology Living things are called organisms. An organism is made up of one or more cells, uses energy, adapts to its surroundings, reacts to changes in its environment, reproduces, grows,...

- M Mathematics 8x and 6 are not “like terms” if the equation was 8x-6x=2x then it would be always true...

Ответ:

Taxable income: 7,500

Paid every two weeks or 26 weeks in a year

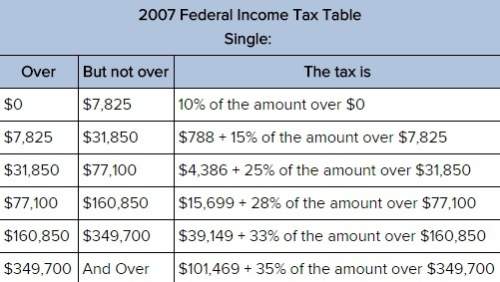

Based on 2007 Federal Income Tax Table for Single Taxpayer, Tim is under the tax range over $0 but not over $7,825. The tax is 10% of the amount over $0.

1. Finds the tax rate for his income level =10 %

2. Enters the base amount = $7,500

3. Enters the amount of tax owed = $7,500 * 10% = $750

4. Divides by 26 = $750 / 26 = $28.85 tax withheld from biweekly wages.

Ответ:

gjrkfkdjthfmdjlfmxggkrl