einsigcn3691

06.12.2021 •

Mathematics

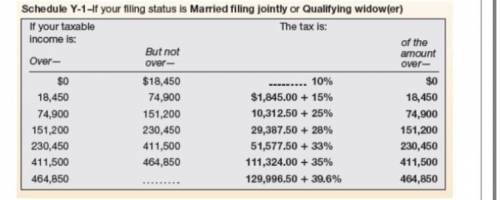

Jake and Gloria are married, filing jointly. Their taxable income without deductions was $406,498. They were able to reduce their total income by $25,381 with deductions. Using Form 1040 and Schedule A, how much was their tax by taking these deductions? Use the schedule below.

Solved

Show answers

More tips

- H Horoscopes, Magic, Divination How to Cast a Love Spell on a Guy? Guide for Guys...

- F Family and Home How to Sew Curtain Tapes: Best Tips from Professionals...

- S Style and Beauty How are artificial nails removed?...

- S Style and Beauty How to Make Your Lips Fuller? Ideas and Tips for Beautiful Lips...

- F Food and Cooking The Disease That Haunted Abraham Lincoln...

- C Computers and Internet How to Get Rid of Windows Genuine Check?...

- H Health and Medicine How to perform artificial respiration?...

- S Style and Beauty Tricks and Tips: How to Get Rid of Freckles...

- C Computers and Internet How Do You Refill Cartridges?...

- A Auto and Moto Battle for the Relocation of The Cherkizovsky Market: Who Won?...

Answers on questions: Mathematics

- M Mathematics 23. © MP.6 Be Precise Draw a number lineand plot a point at each number shown.71100 210 28226 2100...

- M Mathematics Y=-2(x-2)^2 - 3 in standard form...

- M Mathematics A projectile is thrown upward so that its distance above the ground after t seconds is h = -16t2 + 608t. After How many seconds does it reach its maximum height?...

- M Mathematics Indicates which are the relations of the following functions: a) number of loaves of bread we buy and the amount of money we have to pay b) number of 2 $ coins and the amount...

- M Mathematics The frequency distribution below gives the weight in grams of 100 laboratory mice. What is the probability that the weight of a healthy mouse selected randomly from the sample...

- M Mathematics A real estate agent used the mean and MAD to argue that the home prices of Pepper Hill Road were higher and less variable than those of Cinnamon Court. What is the agent s error?...

- M Mathematics Two people start from the same point. One walks east at 9 mi/h and the other walks northeast at 1 mi/h. How fast is the distance between the people changing after 15 minutes?...

- M Mathematics Find the vertex and focus of the parabola. x2 – 10x – 12y – 23 = 0 Vertex: ([?],[]) Focus: ([ ],[ 1)...

- M Mathematics 2 Points Find the solutions to the equation below. Check all that apply. A. x = - B. x = 4 C. x = -2 D. x = E. x = - F. x =...

- M Mathematics Find the solution set of the inequality 8 3+ t/4...

Ответ:

h

Step-by-step explanation:

sure ill chat

plus free points are great