maidadiaz9459

20.01.2021 •

Mathematics

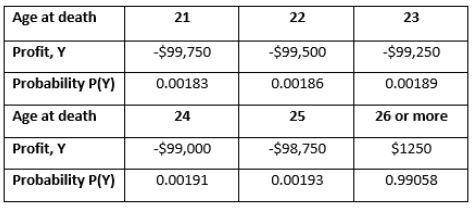

A life insurance company sells a term insurance policy to 21-year old males that pays $100,00 if the insured dies within the next 5 years. The probability that a randomly chosen male will die each year can be found in mortality tables. The company collects a premium, of $250 each year as payment for the insurance. The amount Y that the company earns on a randomly selected policy of this type is $250 per year, less the $100,000 that it must pay if the insured dies.

The Chart Below is the probability distribution of Y

Calculate the expected value of Y. Explain what this results means for the insurance company.

Solved

Show answers

More tips

- F Food and Cooking Why Chicken Liver Pops and How It Can Affect Your Health?...

- F Food and Cooking Effective Methods to Organize Videos in your iPad According to Content...

- F Family and Home Parquet or laminate, which is better?...

- L Leisure and Entertainment How to Properly Wind Fishing Line onto a Reel?...

- L Leisure and Entertainment How to Make a Paper Boat in Simple Steps...

- T Travel and tourism Maldives Adventures: What is the Best Season to Visit the Luxurious Beaches?...

- H Health and Medicine Kinesiology: What is it and How Does it Work?...

- O Other How to Choose the Best Answer to Your Question on The Grand Question ?...

- L Leisure and Entertainment History of International Women s Day: When Did the Celebration of March 8th Begin?...

- S Style and Beauty Intimate Haircut: The Reasons, Popularity, and Risks...

Answers on questions: Mathematics

- M Mathematics If f(x) = (3x+7)^2, then f(1)? a. 10 b. 16 c. 58 d. 79 e. 100...

- M Mathematics Question: 16 ÷ 4 + (1 + 3) = answers: ( a) 2 (b) 7 c) 8 ( d) 15...

- M Mathematics M1q5.) enter your answer as a fully reduced fraction....

- M Mathematics Arrange the steps in the expansion of the binomial in the correct sequence....

- M Mathematics Expand the binomial . the last term in the expansion of the binomial is ....

- M Mathematics Scarlett is designing a package for a candy her company makes. she has cut several cardboard equilateral triangles, squares, rectangles, and regular pentagons to try out...

- M Mathematics Find the tan θ when sin θ= -cos θ and θ is in quadrant iv...

- M Mathematics Iam currently having trouble with this question....

- M Mathematics Anew movie is released each year for 8 years to go along with a popular book series. each movie is 5 minutes longer than the last to go along with a plot twist. the first...

- M Mathematics Mr. smith earns 6% commission on every house he sells. if he earns $9,000, what was the price of the house?...

Ответ:

303.350

Step-by-step explanation: multiply the profit by the probability of all age groups. Then you add up all the answers you had gotten to get the expected value of Y.

Ответ:

A B D E

Step-by-step explanation:

Just did it!